In this world nothing can be said to be certain, except death and taxes

–Benjamin Franklin

This week we saw two big tax stories. You know how there are certain exercises you just hate to do, but you also know those are the ones you should probably be working hardest on, well taxes are like that. We tend to avoid talking about them, but as Ben Franklin put it, they’re here to stay, so we thought we’d dig in and try to understand what these proposals are all about.

- The Highway Bill attempting to fund the country’s infrastructure — in need of repairs and updates. There’s a tax specifically for that, it’s the Gas Tax, and it hasn’t been raised since the 70s. The Highway Bill is praised as a bipartisan effort with Mitch McConnell and Barbara Boxers as the sponsors, but the bill does not raise the Gas Tax instead it looks for creative ways to pay for the necessary repairs. Why you ask? Because the gas lobby doesn’t want to negatively impact consumers spending at the pump. In a rare event this week we saw USA Today and The New Yorker had the exact same headline: Raise the Gas Tax Already! And we agree. Read excerts from those pieces below

- The other tax in the news is Hillary Clinton’s proposal to raise Capital Gains. Though people were outraged, this plan is unlikely to make much of big difference. It would only impact the top earners and it’s intention is to tax those who are profiting from the volatility of the markets, so if you make an investment you should plan to leave there for a few years, we have a great explainer piece for you on the plan and the likely impact.CLINTON’S CAPITAL GAINS PLAN

Clinton: “American business needs to break free from the tyranny of today’s earnings report,” Clinton said. Her progressive proposal is upsetting Wall Street and Fox News, but the impact actually seems minimal. The idea of encouraging those with the most money to invest more long term, and to protect the markets from volatility through trigger happy trading seems logical. This proposal would only impact the top earners.

U.S. Democratic presidential candidate Hillary Clinton speaks during an event at the New York University Leonard N. Stern School of Business in New York July 24, 2015.

The best piece on Clinton’s proposal came from Slate. No surprise here, the piece was written by Jordan Weissmann, who is great at explaining complex financial concepts in comprehensible ways. Here he is on Clinton’s plan:

Here’s how it would work. Today, when Americans sell stocks or bonds that they have held for less than a year, it’s taxed as normal income. If they hold it for more than a year, they pay the lower long-term capital gains rate, which technically maxes out at 20 percent. (However, high earners also pay an additional 3.8 percent surcharge under Obamacare, so the final number is really 23.8 percent.)

Clinton argues, very reasonably, that it’s silly to consider everything a long-term investment after just a year. Instead, she wants to the capital gains rate to decline gradually, so that the longer people hold their stocks, bonds, and mutual funds, the less they pay after cashing them in. For Americans in the top tax bracket, the government would tax investments sold after less than two years like ordinary income. Then, over the next four years, the rate would fall back down toward 20 percent (you have to add the 3.8 percent Obama surcharge onto each of these numbers to get the total tax amount). None of this would affect people outside the highest bracket.

The hope, Mrs. Clinton said Friday, is that giving taxpayers greater incentives to hold investments longer would reduce pressure on corporations to show near-term gains in their share price, so they could focus on making long-term investments and boost worker pay.

“American business needs to break free from the tyranny of today’s earning report so they can do what they do best: innovate, invest and build tomorrow’s prosperity,” the Democratic presidential front-runner said in a speech in New York. “It’s time to start measuring value in terms of years—or the next decade—not just next quarter.”

Under the Clinton plan, the wealthiest Americans would see investment gains taxed on a sliding scale, with the levy dropping the longer the investment is held.

“Most CEOs are simply responding to very real pressures from shareholders and the market to turn in good quarterly numbers,” she said. “It is clear that the system is out of balance.”

Mrs. Clinton’s speech was meant to complete her vision of what she calls “long-term growth.” Coming speeches are expected to focus on how to achieve strong growth, and also growth that is widely shared, and she is committed to releasing a full tax plan at some point.

Her proposal offers a contrast to her Republican opponents, who have mostly suggested ways to cut taxes. In the case of capital-gains taxes, some are urging elimination of them, which they say amounts to double taxation on investors. Sen. Marco Rubio (R., Fla.) has a plan to reduce tax rates for individuals and corporations. Kentucky Sen. Rand Paul wants to scrap the current code and replace it with a flat tax. Texas Sen. Ted Cruz would abolish the Internal Revenue Service.

Here’s some background on the Capital Gains Tax from Time:

How are capital gains currently taxed?

While the tax rate on capital gains has bounced around a lot over the years, the big tax deal reached in the last hours of 2012 pushed up the top rate on long-term capital gains to 20% — still far lower than the 39.6% top rate on income (although top earners also pay a health-care related 3.8% surtax on investment income). For taxpayers in lower brackets, long-term capital gains tax rates max out at 15% or less.

There is an exclusion for profits of up to $250,000 ($500,000 if you are married) on your primary residence, so many homeowners won’t have to worry about a huge tax bill when they move.

That’s all for long-term capital gains, by the way. Short-term capital gains — that is, the profit made on stocks or other assets held less than a year — get taxed at the same rate as income.

Why do capital gains get a tax break?

In the relatively recent past, both Democratic (Bill Clinton) and Republican (George W. Bush) presidents have cut the capital gains rate in hopes that doing so would spur the economy. Since the capital gains tax is really a tax on investment, economists hopethat lowering the tax will prompt people to invest more of their money rather than spend it.

The idea is that if more people are looking to invest, it should be easier for start-ups or existing companies that want to develop new products to find funding.

That’s also why short-term gains get taxed as income — because short-term gains benefit people who make their living buying stuff and then quickly reselling, rather than investing for the long term.

So what’s the problem?

In addition to spurring investment, a low long-term capital gains rate also spurs inequality. It’s not hard to see who the biggest beneficiaries are: people who invest in the stock market or who sell businesses that they own.

The low capital gains rate is one reason America’s 400 biggest earners paid a tax rate of less than 17% in 2012, the latest year for which the IRS has released data. There are also questions about whether the low capital gains rate really does boost the economy.

After all, while the economy took off under Bill Clinton, the stock market has also continued to soar since the most recent increase in the long-term gains rate.

What is Hillary Clinton proposing instead?

Hillary Clinton’s proposal would require wealthy taxpayers to hold their investments much longer to get the full long-term capital gains tax benefit. Instead of a single long-term gains rate that kicks in after one year, her plan would create a series of rates ranging from 36% to 24% for those who hold investments for at least two years but less than six years.

Clinton says she isn’t doing this simply to raise taxes on the rich. Rather it’s to discourage short-termism among big investors. That’s something even many on Wall Street regard as a problem, even if higher taxes might not be their preferred solution. So it looks like good politics.

Is it a good idea?

That, of course, depends on who you ask. Many progressives would simply like to see capital gains taxed as income.

Yet it’s not even clear whether Clinton’s proposal could actually change investor behavior — even if it could pass Congress. “My general impression is deep skepticism,” Leonard Burman, director of the nonpartisan think tank the Tax Policy Center told Reuters earlier this week. “Frankly, I don’t see the logic in trying to encourage people to hold assets for longer than they want to.”

HIGHWAY BILL/GAS TAX:

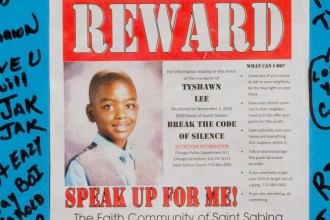

The gas tax introduced by Senate Majority Leader Mitch McConnell and Dem Senator Barbara Boxer — a bipartisan effort, would help fund highways. But there are problems with the funding source. It was funny to see multiple publications with the same headline: “Raise the Gas Tax Already.”

Here’s USA Today’s: Raise the Gas Tax Already:

Unlike many problems, this one has a simple solution. The 18.4-cent-a-gallon federal gasoline tax hasn’t been raised since 1993. Thanks to a worldwide oil glut, gas prices have dropped so far that Congress could quintuple the gas tax without pushing pump prices above where they were at this time last year. Merely restoring the tax to its 1993 level (a little more than 30 cents in today’s dollars) and indexing it for inflation would be a big start toward a major infrastructure upgrade. And given the volatility of prices at a pump, motorists would barely notice the 12-cent increase.

But will Congress adopt such an obvious fix? Of course not. Too many of its members have signed away their souls to gatekeeper groups. In return for these groups being nice to them, lawmakers have promised not to raise taxes for any reason at any time.

Congress has resorted to a string of short-term “fixes” to make up for the gas tax revenue lost to inflation and more fuel-efficient vehicles. Some 33 such fixes have been passed in the past decade. One recent fix raises cash by allowing corporations to underfund their pensions (resulting in them having more taxable income).

Here’s the New Yorker’s version of: “Raise the Gas Tax Already”

The federal gas tax is, as it should be, a key source of funding for highway spending. Currently, the tax is 18.4 cents per gallon. The problem is that it has been 18.4 cents per gallon since 1993. And since the cost of building and, above all, repairing roads has risen substantially in the past twenty-two years, because of inflation and because the federal highway system is deteriorating, while the revenue from the gas tax hasn’t risen nearly as much, Congress has had to find other ways to make up the difference. In recent times, those fixes have all been short term, which is why the Boxer-McConnell plan, which would fund spending for three entire years, seems to some like a real improvement.

The problem is that the funding mechanisms the plan relies on are as gimmicky and haphazard as ever. The bill would raise money by, among other things, lowering the dividend rate paid to banks in the Federal Reserve system, raising certain customs fees, increasing collection rates on unpaid taxes, and selling off a hundred and one million barrels of oil from the country’s Strategic Petroleum Reserve. Some of these may, on their own, be reasonable ideas—although, if you’re going to have a Strategic Petroleum Reserve, you should probably only sell oil from it for strategic reasons, not just because you want to raise some cash. But they are, for the most part, stopgap measures, meaning that Congress won’t be able to rely on them the next time around. And, from an economic perspective, paying for operating expenses by selling off assets is not a good way to manage your money.

What’s especially infuriating about the bill is that we already have, in the gas tax, an ideal tool for raising money to pay for highway repairs. It’s a user tax: if you don’t drive you don’t pay it, and if you drive less it costs you less. It helps to correct, at least mildly, a clear market failure: people who drive don’t pay the full costs of the externalities they create, including the wear and tear they put on roads, the pollution they emit, and the congestion they help produce. And while certain taxes disincentivize, to some degree, things we like (such as work or investment), the gas tax, by raising the cost of driving, gets us less of things we don’t like (pollution, carbon emissions, and road wear). That’s why even conservative economists, like Gregory Mankiw, have been ardent advocates of gasoline taxes. This is also an excellent moment to raise the gas tax, since oil and gas prices are so much lower than they were, making any price increase at the pump more palatable to drivers.

Indeed, the refusal of Congress to raise the gas tax is the ultimate expression of how reflexive and irrational the resistance to taxes has become. Opposition to higher income taxes has some theoretical justification: higher marginal rates discourage people from working more and investing. Seen in one light, they’re a penalty for success. But no such argument exists against the gas tax: all it does, in essence, is ask drivers to pay for the roads they use. It’s not even fair to say that keeping this tax at its current level is a check on big government, since most federal highway spending now goes toward rebuilding and repairing roads—maintenance that even conservatives recognize we must do.

Highway revenue has to be raised somehow. Congress should show some political spine, discard the Rube Goldberg funding schemes, and stop treating all taxes as bad ones.